Why do employees need support to build emergency savings?

Consistently in Nest Insight surveys, including through the pandemic and the recent rise in the cost of living, almost everyone says that saving money for an emergency is important.[1]

Financial needs can be unpredictable. Financial shocks – a major appliance breaking, school shoes needing replacing or an unexpected bill – can hit at any time. An emergency savings pot allows people to pay for unexpected expenses without having to turn to high-cost credit.

Having a savings buffer can provide peace of mind and build financial confidence. Those with a buffer often report higher levels of subjective wellbeing and life satisfaction, and they’re more productive at work as a result.[2]

We’ve seen in our multi-year, multi-employer sidecar saving trial that some people effectively use accessible savings accounts to budget and manage their expenditures across a pay period.[3] This financial strategy might be particularly helpful to households in the context of rising costs.

Yet it’s estimated that a quarter of adults in the UK have less than £100 in savings.[4]

It can be hard to get started with saving.

Our research suggests that employers have a powerful potential role to play in supporting saving, particularly among those who have lower financial confidence and literacy.

What is opt-out payroll saving?

Taking an opt-out approach to payroll saving means that employees automatically start saving into their own accessible savings account through payroll contributions unless they choose not to. If they want to start saving, they don’t need to do anything. Everything is done for them. Only people who don’t want to save have to take action.

The approach preserves individual choice while also making it easier for people to get started with short-term saving. It can be offered alongside auto enrolment into a pension.

References

We hope that our published reports and guides are helpful to those thinking about how to scale support for savings in the workplace. If your organisation is interested in offering opt-out payroll saving, and you have further questions on the insights and evidence from the trials, please do get in touch: insight@nestcorporation.org.uk

Financial stress and its impact on the workplace

A significant proportion of UK workers have little or no money put aside for emergencies. One quarter of adults in the UK have less than £100 in savings.[1]

The increasing cost of living has put more pressure on households’ finances. Saving has become more difficult and the importance of having a savings buffer has become even more relevant.

Having even a small amount of savings can provide some financial resilience and peace of mind. People without a savings buffer are three times more likely to report very low levels of happiness compared with those who have savings.[2]

Improving the financial wellbeing of the workforce has a number of benefits for employers too. More financially resilient workforces have on average:

- Better performers – Over 1 in 4 employees say money worries affect their ability to do their job.[3] Having a financial buffer can provide some peace of mind, allowing employees to be more focused at work.

- Improved labour market appeal – Over 3 in 4 employees say they would be attracted to move to another employer if they perceive it to care more about their financial wellbeing. About 2 in 3 think it’s important for an employer they’re interviewing with to have a policy in place to improve employees’ financial wellbeing.[4]

What is opt-out payroll saving?

Taking an opt-out approach to payroll saving means that employees automatically start saving into their own accessible savings account through payroll contributions unless they choose not to. If they want to start saving, they don’t need to do anything. Everything is done for them. Only people who don’t want to save have to take action.

The approach preserves individual choice while also making it easier for people to get started with short-term saving. It can be offered alongside auto enrolment into a pension.

What impact could opt-out payroll saving have?

Employers who have implemented an opt-out approach to payroll saving have seen employee participation rates jump by around 50 percentage points. In our trials, up to 7 in 10 workers save when opt-out approaches are used.

The savings approach is both powerful and popular. Over 93% of employees surveyed say they like scheme, whether or not they themselves choose to save. Employees are very positive about the opt-out approach, with many saying they feel more loyal to their employer and wish all employers supported saving in this way.

How can opt-out payroll saving be offered in workplaces?

Here we share top-level learnings on how three organisations implemented opt-out payroll savings, using three different approaches – new employee onboarding, new employee benefit app sign-ups and new employee employment contract:

- Case 1. New employee onboarding – SUEZ and TransaveUK

- Case 2. New employee benefit app sign-ups – Bupa, Co-op and Wagestream

- Case 3. All employee employment contract change – University of Lincoln and Cushon

Read our employer guides

To find out more about how your organisation could offer opt-out payroll saving, read our employer guides.

You can also get in touch with us: insight@nestcorporation.org.uk

Quick links

- The benefits of supporting employees to save

- What does a good workplace accessible savings offer look like?

- What is an opt-out approach, and why use it to support payroll saving?

- Designing an opt-out autosave approach for your employees

- Choosing the best method for your workforce

- FAQ’s – workplace emergency savings

- Business case – workplace emergency savings

- Supporting people to save – workplace emergency savings

Other resources

- Hard times: How the cost-of-living crisis is affecting the workplace (CIPD)

- Employee financial wellbeing: Guidance for HR practitioners and employers to support their employees’ financial wellbeing (CIPD)

- Financial Wellbeing Research 2023 (REBA)

References

Short-term saving is vital for UK households and the wider economy

Setting aside some money for a rainy day can cushion people against financial shocks and provide financial security. Yet, many UK households don’t have this kind of buffer, and this has a big impact:

- 1 in 4 UK adults have less than £100 in savings.[1]

- 1 in 3 people in the UK wouldn’t be able to pay an unexpected but necessary expense of £850.[2]

- 1 in 3 (16 million) people in the UK missed payments on vital bills in 2023, with over 2 million doing so for the first time.[3]

- 1 in 5 people often borrow money, use a credit card or use an overdraft to pay for essentials like food and heating.[4]

- 3x more likely to report very low levels of happiness among people who have no savings buffers compared with those who do.[5]

Having even a small emergency savings buffer can:

- Reduce problem debt – Nearly 6 million low-income families had unsecured debt as of May 2023,[6] and in the last three years, over 3 million UK households may have borrowed from an illegal moneylender.[7] If a household has £1,000 in quickly accessible savings, it reduces, on average, the chance of getting into problem debt by 44%.[8]

- Boost wellbeing – Having savings can have considerable benefits to wellbeing:

- Just under half (46%) of those not saving regularly reporting feeling anxious with regard to money.[9]

- Long-term financial insecurity can have a significant impact on people’s mental health. In England alone, over 420,000 people in problem debt consider taking their own life each year, and more than 100,000 people in debt actually attempt suicide.[10]

- For victims of domestic abuse, a lack of access to savings and increasing debts may mean they feel unable to leave abusive relationships. Research has shown that a woman who can’t access £100 at short notice is 3.5 times more likely to experience domestic abuse.[11]

- Support retirement saving – Having and using emergency savings accounts can make households financially more secure, and thus able to save more for their retirement. A study of saving among UK workers in their 30s and 40s found that financial resilience was the strongest predictor of discretionary retirement saving. Research in the US has shown that people with emergency savings are 70% more likely to contribute to their defined contribution (DC) retirement plan.[12]

The UK’s saving rates, particularly among those on a low or moderate income, are low by international standards.[13]

The need to increase savings participation is recognised in the UK Money and Pensions Service’s 10-year UK Strategy for Financial Wellbeing. The strategy includes a ‘Nation of Savers’ ambition, with the goal of two million more working age financially ‘Struggling’ and ‘Squeezed’ people saving regularly by 2030.[14] We believe this could be achieved through the workplace.

Why opt-out payroll saving is the solution

What is opt-out payroll saving?

Taking an opt-out approach to payroll saving means that employees automatically start saving into their own accessible savings account through payroll contributions unless they choose not to. If they want to start saving, they don’t need to do anything. Everything is done for them. Only people who don’t want to save have to take action.

The approach preserves individual choice while also making it easier for people to get started with short-term saving. It can be offered alongside auto enrolment into a pension.

Key research findings

- Opt-out payroll saving supports many more people to save: Employers who have implemented an opt-out approach to payroll saving have seen employee participation rates jump by around 50 percentage points, compared to opt-in approaches. In our trials, up to 7 in 10 workers save when opt-out approaches are used.

- Opt-out payroll savers are active savers: People who start saving through an opt-out approach build meaningful savings buffers over time. They also actively use their accounts by withdrawing money when they need it.

- Employees like opt-out payroll saving: Around 9 in 10 of employees surveyed say they like scheme, whether or not they themselves choose to save.

- People’s other financial behaviours aren’t negatively impacted: The data from our trials suggests there is no crowding out of pension saving as a result of introducing opt-out payroll saving directed to instant-access savings pots.

- Opt-out payroll saving supports employee financial wellbeing over time: People use their workplace savings accounts in different ways. Knowing that they’re saving gives people greater peace of mind and confidence.

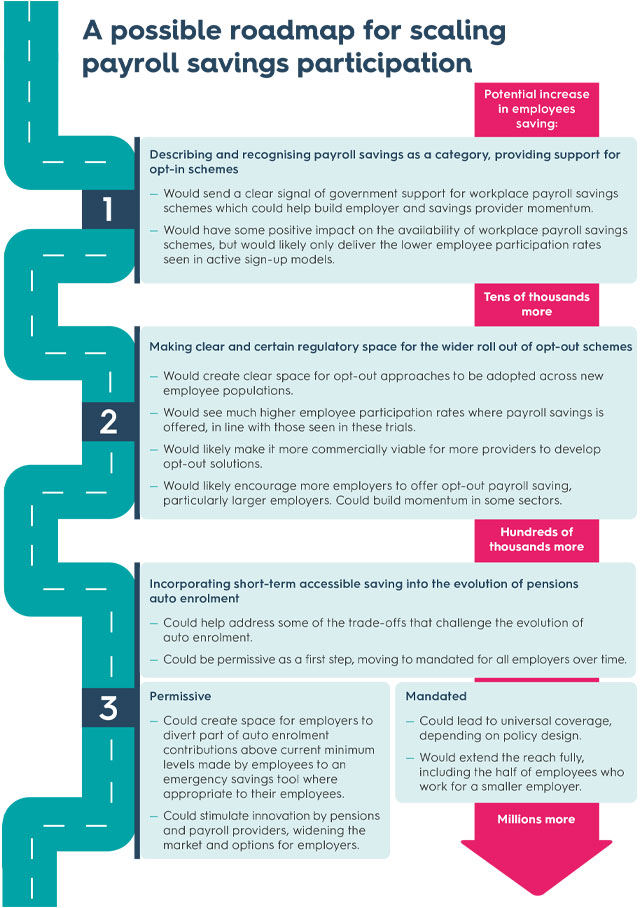

How could the savings approach be scaled for widespread use across the UK?

If you’re interested in sharing your thoughts on scaling opt-out payroll saving, you can also get in touch with us: insight@nestcorporation.org.uk

Quick links

- What do employees think about emergency saving via workplace payroll? (Video)

- Opt-out payroll saving: the regulatory considerations (PDF)

- Workplace emergency saving: A landscape review of existing evidence (PDF)

- Our research reports

References

The regulatory considerations

When designing opt-out payroll savings approaches, there are a number of considerations related to:

- Employment law

- Data protection Law

- Financial Services regulation

- International tax obligations.

In this paper, we set out our understanding of the current situation, which is based on both the practical lessons from developing our trial and conversations with stakeholders.

Many of these considerations make employers and regulated providers unsure about how they can offer opt-out payroll saving to their workforce and members, despite a desire to offer it.