A practical guide to communicating with employees about an opt-out approach to payroll saving

Our workplace emergency savings research programme is focused on understanding the role workplace saving could play in improving financial resilience and wellbeing in the UK. As part of this, we are exploring the impact of introducing an opt-out approach to payroll saving.

Research shows that most people want to save, and that having some accessible savings improves financial security and wellbeing, particularly for those on low to moderate incomes. However, many people struggle to get started with saving because behavioural and cultural barriers get in the way. This is true even when they work for an employer that offers the opportunity to save through payroll – take-up rates remain stubbornly low despite employees seeing the value in emergency saving.

An opt-out, or ‘autosave’, approach helps employees to get started with saving, if they want to. Instead of having to actively sign up to save, employees automatically start saving through payroll if they don’t opt out. Each payday, some of their pay is moved into their own accessible savings account. If they want to, at any stage, they can increase or decrease the amount they are saving, or pause or stop saving altogether. They can access the savings at any time, quickly and without penalty or conditions.

| The success of an autosave scheme relies heavily on easy-to-understand and transparent communications, ensuring everyone has the information they need to make an informed decision about saving that is right for them and their financial situation. We therefore set about speaking to employees who have experienced autosave, as well as those who haven’t, to find out more about how the approach is perceived and how it should be communicated. | “There was ample opportunity to opt out if that’s what I wanted to do, but I decided to stay in because that was the right thing for me […] it actually feels a little bit empowering to be putting away this amount every month.” |

What does the communications guide cover?

Based on our research, we’ve developed a practical guide to outline some of the key learnings about how autosave can most effectively be communicated to employees. The communications tested were based on those currently used in the SUEZ recycling and recovery UK and TransaveUK autosave trial. We will continue to build on and amend this approach as the evidence base grows.

Read the guide: Talking about payroll autosave with employees: a practical guide to communicating an opt-out approach to payroll saving (PDF)

| Any organisation offering autosave will need to tailor communications, bearing in mind the specifics of the employee-base, the structure of the autosave scheme, and the communication platforms available. Therefore, this guide does not provide templates for communicating payroll autosave but rather suggests several key principles and messages to consider. We provide a summary here of some of these key considerations. | “It’s pretty much black and white, isn’t it? If you don’t want to save, you don’t need to.” |

How should autosave feel for employees?

Offering autosave should be about making it easier for employees to make the saving decision that is right for them, removing barriers like inertia and choice overload that can stop people converting their intention to save into action. Consequently, all communications should be clear and transparent and make employees feel:

- Confident – “I understand how payroll autosave works, what to do if I don’t want to save and what will happen to my money if I do. I have confidence in the motives of my employer and the provider, and I know that if I save, my money is safe.”

- In control – “I can make a choice that’s right for me. If I decide to save, I know I can flex the account to meet my needs and access my money at any time I need to.”

What messages should be included in communications?

Although language and exact wording will need to flex to each employer context, an effective autosave communication should include the following messages:

| Message | Example language |

| Saving can give you peace of mind | |

| Explain why you as an employer or provider are offering the savings programme and what the benefits are. | “Regularly putting money aside can help you to build financial security and feel more prepared, which can also improve your wellbeing.” |

| It’s your choice | |

| Include clear opt-out instructions with a simple one click/email opt out. | “You can easily opt out now if you want to by emailing…” |

| It’s easy | |

| Give clear simple information suited to low levels of financial literacy and confidence and be clear that no action is required to start saving. | “Even if you’ve never saved before, you can start saving easily now.” “You don’t need to do anything – it’s all taken care of.” “Your account will be set up for you and you will save regularly automatically.” |

| It’s flexible | |

| Provide reassurance that default settings can be changed easily and at any point. | “You can change the amount you save either up or down.” “You can pause or stop saving at any time.” “You can take some or all of your money out at any time for any reason.” |

| Your money is safe | |

| Explain who the provider is and give proof points for why they can be trusted. Provide links to provider and Financial Services Compensation Scheme information, and account terms and conditions where appropriate. | “Our savings provider is regulated and trustworthy.” “Your savings are protected so there’s no risk of losing your money.” |

| There’s no cost | |

| Provide reassurance that there is no catch, and the scheme is set up to be in employees’ interests. | “There are no fees for using the product.” “There are no penalties for withdrawing your money.” |

What should be avoided?

Some traps to avoid and things to watch out for in communicating payroll autosave include:

| Language that suggests money is deducted or taken from pay | The money saved is still the employee’s money – it is partitioned for them into a savings account in their own name. So, talking about “moving” or “adding” money to their savings through payroll is more accurate and avoids feelings of loss. |

| Hiding the opt-out | The aim of autosave is not to have all employees saving through payroll, it’s to give those who want to save a helping hand. Making sure employees can make the optimal decision for their circumstances means foregrounding details of how to opt out, rather than hiding them. If people feel ‘pushed’ to save there is likely to be a negative response. |

| A focus on savings balance, rather than saving behaviour | Whilst other forms of saving are designed to incentivise people “keeping their money in” and building a savings balance, accessible savings are there to be used when needed. People need a buffer in place before they can build savings for the longer term. Reward and reinforce the savings habit rather than the balance. |

| Over focussing on interest rates or dividends | These are complex financial concepts and can be off-putting for those unfamiliar with them. For those new to saving, they may also be lower priority than other benefits of the scheme such as ease and accessibility. |

| Jargon, technical concepts or too much detail | Autosave is designed to help employees get started with saving, even if they lack confidence or financial literacy. Many employees are daunted when faced with language relating to tax and financial services (for example “net pay” and “pre-tax”). Try to use words colleagues would use like “take-home pay” and “cash savings.” Too much information can also be off-putting. Information should be layered – with a quick and simple way through for those who want the bare minimum information, and links to more detailed content for those who are more confident. |

| Being overly prescriptive about what the savings should be for | Employees will use payroll saving in different ways to meet different needs. It can be helpful to suggest broadly how savings could be used, but employees should feel able to decide for themselves what their savings are for and will often have multiple goals. |

| A lack of clarity on roles | Where an employer is offering payroll savings as a benefit, employees may fear that their employer will find out about their personal finances, or even that their employer is benefitting financially from their saving. Be clear on what the employer and provider roles are, and that employees’ personal finance information, such as balances and withdrawals, will be kept confidential by the provider. |

The employee journey

There is more than one way to communicate payroll autosave to employees. How this should be done will depend on factors including:

- whether the scheme is offered by an employer or provider

- the communication platforms available

- the location of employees

- whether autosave is offered to all employees or only new joiners.

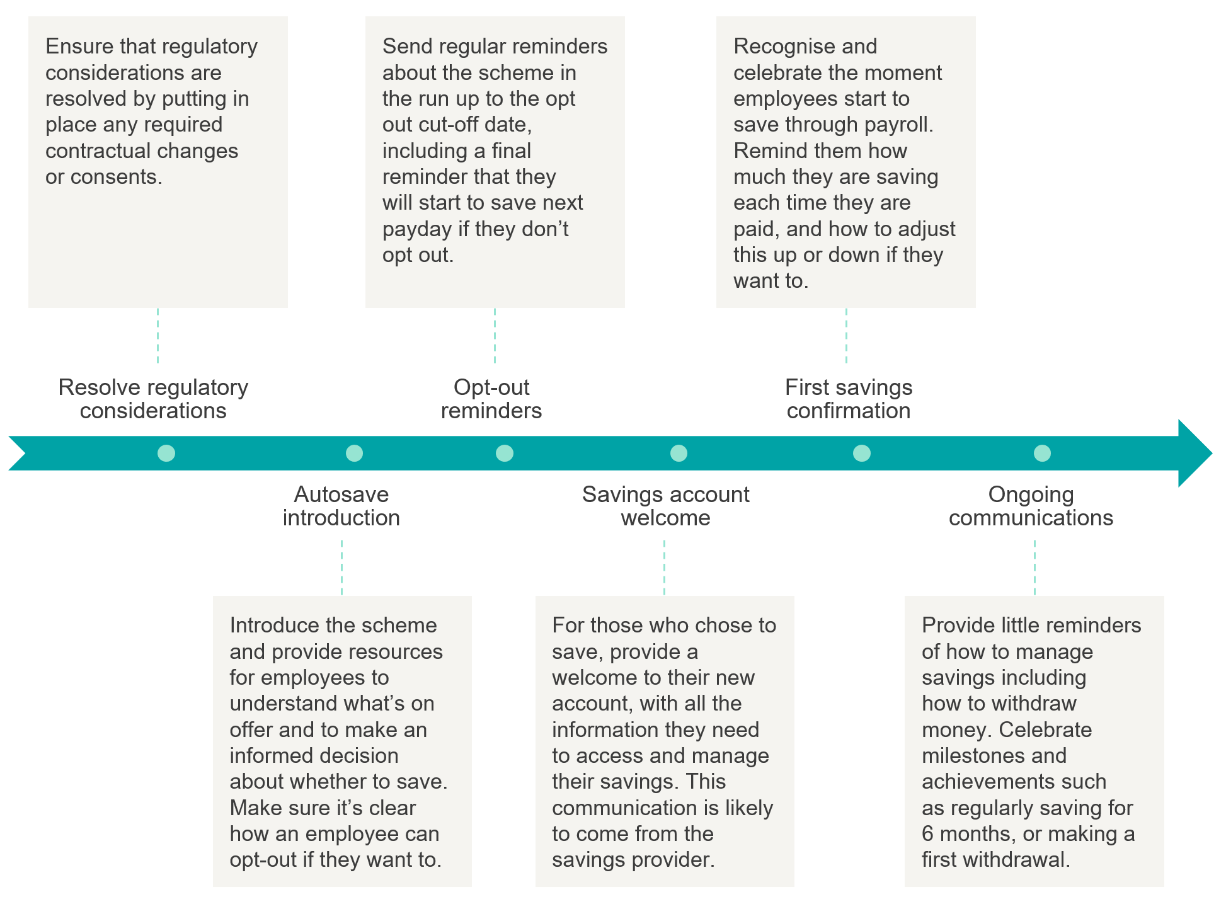

However, a clear, transparent and engaging communication journey for employees could include these steps whatever the context and design:

Further information

To find out more, read our guide: Talking about payroll autosave with employees: a practical guide to communicating an opt-out approach to payroll saving (PDF)

If you’re interested in what employers and providers think of the idea of opt-out payroll saving, the perceived barriers to implementation and how they might be overcome, take a look at our report: Opt-out payroll savings: a new way to support financial wellbeing in the UK? Industry and employer perspectives (PDF)

If your organisation is interested in collaborating with us on savings pilots and research, or would like to find out more about our work, please get in touch: insight@nestcorporation.org.uk.

Jo Phillips and Emma Stockdale, Nest Insight

About this guide

This guide aims to give employers and providers a view of some of the key considerations when communicating an opt-out approach to payroll saving. If you are in any doubt about how legislation and regulation apply to opt-out payroll saving, or your organisation, we recommend that you seek specialist legal advice. We don’t make any representation or warranty, express or implied, that the communications included in this guide are accurate, complete or error free. We don’t accept responsibility for any loss caused as a result of reliance on the communications contained in this guide, which are intended to be for guidance only, nor do we accept responsibility for loss caused due to any inaccuracy, incompleteness or error.