Nest Insight recently joined a diverse range of tech businesses, financial providers and consumer representatives in a race against the clock to design innovative ways to make retirement saving easy for the self-employed. This Tech Sprint was, for us, an important part of our ongoing project to develop and test savings interventions for this ever-growing category of workers. We walked away with a few prizes and, more importantly, a deeper understanding of the kinds of digital solutions that might be effective in helping contingent workers save.

The Tech Sprint was sponsored by the government, run by the Association of British Insurers and hosted at Aviva’s Digital Garage innovation centre in London’s Tech City. It was part of the Department for Work and Pension’s response to its own 2017 review into auto enrolment. That review proposed that the government and industry should collaborate to identify and pilot interventions that can increase long-term savings rates among self-employed people – a recommendation that’s very much in the spirit of our own research programme.

The Tech Sprint was a way of galvanising the combined expertise of a diverse range of organisations to create prototype solutions that might be taken forward to further testing. Over a rapid two-day process, the organisations worked in teams to create prototype apps and other technological tools that might help encourage different types of self-employed people to save for retirement. To keep everyone focused on the real needs of contingent workers, the teams used a set of illustrative personas, based on market data.

Nest Insight was represented by Matthew Blakstad, our head of research, and Professor Jonny Freeman of Goldsmiths College’s i2 Media lab, a key partner in our self-employed research, also took part. Both of our teams focussed on designing savings platforms for gig economy workers, and took a similar approach to this challenge. The key insights we used were:

- Self-employed people’s biggest challenge is uncertainty. They value having money on hand to deal with the unexpected, so they may be less likely to ‘give up’ liquidity than traditional workers.

- Many gig economy workers use multiple gig platforms to access the labour market, and they may change these employments over time.

- Gig economy platforms have an interest in supporting the financial wellbeing of their gig workers, but they’re unlikely to take accountability for providing benefits like payroll savings as this would undermine their business models.

Prototype solutions

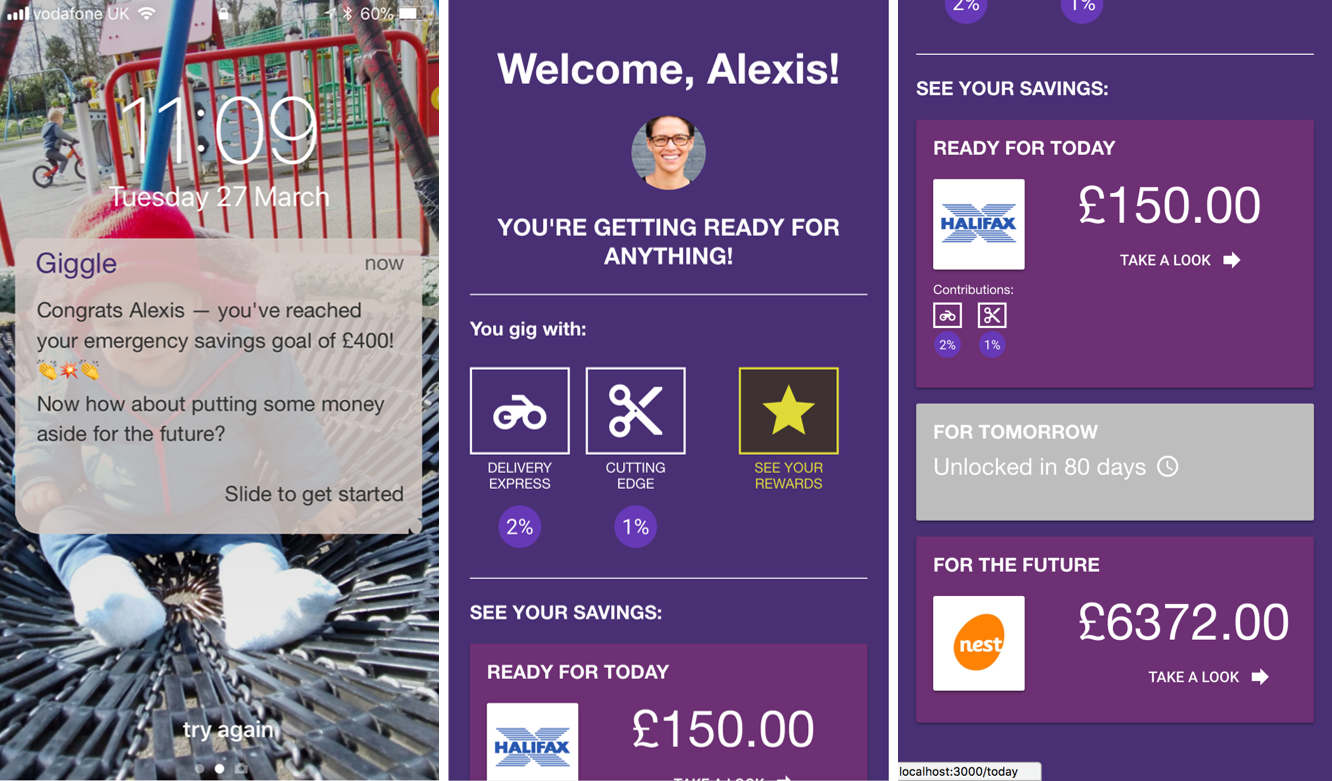

Our prototype solutions introduced new, centralised savings apps that could be integrated with a range of different gig platforms. This new savings ‘hub’ might even be part-funded by the platforms, because it would help them deal with a perceived gap in what they offer to the workers who use them.

In designing the new app, we took into account the three separate challenges involved in encouraging long-term savings:

- Getting started. The worker is automatically signed up to the new app by their gig platform. The app would then use services like open banking and the pension dashboard to pull together their full savings profiles into one place. When the worker accesses the app, they’re offered default savings options, and also the opportunity to edit these if they prefer.

- Persistent saving. To get the most out of their investment in the savings hub, the gig platforms would use smart behavioural nudges to make the saving process as seamless and invisible as possible for the worker. This might include shaving a small percentage of the income from each ride or task, or perhaps committing their earnings from every 20th job to their savings.

- Getting the product right. By pulling together liquid and illiquid savings in one place, the worker can start out by saving in a fully liquid account. When they’ve reached a big enough savings buffer, to meet their short-term needs, the app will start diverting some of their savings to their illiquid retirement savings. This helps ensure that the app meets their desire for a liquid buffer to protect them from the unknown.

Both teams were awarded prizes by the Tech Sprint judging panel for their approaches, but more importantly we’re now looking for ways to translate the insight generated from this session to our ongoing research work. We will look to incorporate the insight and ideas generated in the Tech Sprint as we work our partners to test and pilot real-world interventions over coming months.